2024 US election result: Market implications

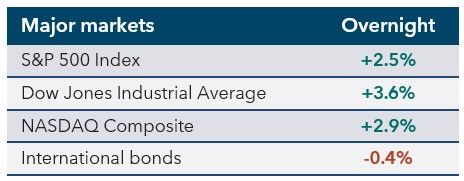

The immediate market response has been strong, reflecting both the relief of reduced uncertainty and anticipation of significant policy shifts. US shares surged 2%-4% overnight, led by gains in small-to-mid-cap shares. Fixed interest (bond) markets sold off with a sharp rise in 10-year US Treasury yields, and the US dollar strengthened.

Market outlook

With a pro-growth agenda, the Republican victory has sparked market expectations for tax cuts, deregulation, and increased fiscal spending — all likely to boost company earnings and encourage business investment. Small-to-mid-sized companies, and sectors like energy, pharmaceuticals, and financials will likely benefit most. Plans to reduce or reverse immigration may lead to labour shortages in construction, restaurants, and healthcare sectors.

Expectations that the fiscal deficit will rise may push bond yields higher — a potential outcome of fiscal spending is that it stimulates economic growth and leads to fewer US Federal Reserve (Fed) rate cuts. Additionally, higher fiscal deficits mean more US Treasury debt issuance, putting further pressure on bond yields to rise. Higher interest rates may attract greater foreign investment into US markets, pushing the US dollar higher.

Key risks

Higher bond yields could weigh on returns from shares and bonds, particularly if driven by a rise in inflation. The Fed may slow or pause its anticipated rate-cutting path or even hike rates if growth accelerates and triggers a pick-up in inflation. Trump’s proposed tariffs on imported goods could also be inflationary, harm growth, strain global trade, and ultimately impact company earnings.

Implications for investors

Markets have responded positively to the growth prospects under the Trump administration, but investors should remain watchful amid risks of rising bond yields and possible trade tensions. Although Trump’s win signals opportunities in certain sectors, a selective approach will be key for investors navigating the post-election landscape. While elections can cause short-term volatility and shifts in investor sentiment, medium to long-term market performance is ultimately influenced by economic fundamentals and global events.