Financial Update December 2024

The highlights:

- Donald Trump secured a return to the White House, and the Republican party achieved a clean sweep in Congress. This resulted in a continuation of the so-called “Trump trades” that had begun in anticipation in October, with investors favouring market sectors expected to benefit from Trump’s policies.

- International shares enjoyed solid gains in November, but the returns were mixed regionally depending on the perceived impacts of a Trump presidency.

- US shares surged ahead but Asia and Europe lagged. Meanwhile, Australian shares rebounded in November to set new record highs.

- Global and local fixed interest markets finished the month positively, rebounding from early volatility. Bond yields initially climbed on fears that Trump’s inflationary policies might lead to prolonged higher interest rates, but later declined as these concerns eased.

Market observations

November 2024 saw robust gains across financial markets, driven primarily by the outcome of the US presidential election. With Donald Trump securing a return to the White House and the Republican party achieving a clean sweep in Congress, investors leaned into “Trump trades”, anticipating policy shifts favourable to certain sectors and the broader economic outlook.

The rotation into assets poised to benefit under a Trump administration began in October, as expectations of a Republican victory strengthened. Once the election results were confirmed, the pace of this shift accelerated. US shares rallied strongly, led by the financials sector, which will likely benefit from a more lenient regulatory environment under Trump. The consumer discretionary sector also performed well, with sector heavyweight Tesla leading the charge as markets viewed the improving relationship between Trump and Elon Musk as a tailwind. Small-caps delivered notable outperformance in November, buoyed by optimism around a robust US economic outlook and the potential for more business-friendly policies. The US dollar continued to strengthen.

Bond yields initially rose as investors considered the inflationary implications of Trump’s policies.

The yield on the 10-year US Treasury climbed to 4.45% by mid-November, briefly dampening share market enthusiasm. However, yields eased off in the latter half of the month, providing relief for shares globally and pushing the US market to new highs.

While US shares flourished, markets in trade-focused economies such as Europe, Japan, and China were sold off on concerns over the prospect of trade tariffs. In contrast, Australia grappled with internal economic challenges. A weaker-than-expected GDP print underscored the strain on Australian households, marking the seventh consecutive quarter of per capita GDP contraction. The nation remains in a ‘per capita recession’, with headline growth propped up by strong immigration. Nevertheless, shares in the Australian banks continued their remarkable rally, with the Commonwealth Bank of Australia now trading on a lofty 26x forward price-to-earnings (PE) ratio.

As markets head into the final stretch of 2024, expectations remain high. Investors will closely watch the Trump administration’s ability to deliver on growth policies, central banks’ stance on rate cuts, and corporate earnings growth. With the MSCI World Index trading at a forward PE of 19.9x, valuations appear stretched. The sustainability of these recent gains hinges on robust growth materialising in 2025.

Economic review

Australia

Australia’s economic landscape remains challenging, with core inflation — the Reserve Bank of Australia’s (RBA) preferred measure of inflation that excludes volatile items — rising to 3.5% in October. The RBA held the cash rate steady at 4.35% during its December meeting, without considering a rate cut. However, Governor Michele Bullock expressed increased confidence that inflation is trending toward the 2-3% target range, raising the likelihood of a rate cut by April or May next year. Notably, the RBA dropped its previous stance of "not ruling anything in or out" regarding further rate hikes. This shift was widely interpreted as a dovish signal, suggesting the possibility of rate cuts, rather than rate hikes, ahead.

Australia’s labour market remains resilient, with the unemployment rate for October flat at 4.1%. The labour force participation rate declined marginally to 67.1%, suggesting a small reduction in workforce engagement. Early Black Friday discounts and improved consumer sentiment saw retail sales increase by +0.6% in October, marking the third consecutive month of growth. Despite these developments, declining labour productivity raised concerns about living standards and economic sustainability and prompted calls for structural reforms to enhance productivity and economic growth.

US

The US economy remains strong, with consumer spending increasing more than expected, indicating sustained growth momentum into the final quarter of the year. Inflationary pressures persist, as core PCE inflation rose 2.8%, up from 2.7% in September, with rising services costs outweighing declining goods prices. The US labour market rebounded in November, following October’s hurricane-affected figures, but the unemployment rate rose slightly to 4.2%.

In response to the mixed but broadly positive economic indicators, the Fed reduced the federal funds rate by -0.25%, resetting the target range to 4.50%–4.75%. Fed Chair Jerome Powell stated, “the US economy is in good shape,” and “significant progress” had been made in lowering inflation toward the Fed’s 2% goal. He emphasised that future monetary policy decisions would be data-driven, aiming to promote maximum employment and price stability.

Donald Trump’s presidential victory and the Republican party securing a majority in both the Senate and House of Representatives fuelled expectations that the next government’s policies would extend American exceptionalism in the economy.

Europe

Eurozone inflation rose to 2.3% in November from 2.0% in October, driven by base effects as last year’s energy price declines faded. Despite inflation increasing, eurozone growth remained weak, with the European Central Bank (ECB) expected to trim its deposit rate by 0.25% when it meets in mid-December to support the economy. With price pressures in the UK easing and inflation now below the Bank of England’s (BoE) 2% target, the central bank cut its key rate from 5.00% to 4.75%.

Asia

Chinese inflation fell to a five-month low in November, indicating that Beijing's recent measures to boost economic demand have had limited success. This outcome persists despite ongoing government stimulus efforts. As the world’s second-largest economy faces the prospect of new tariffs under a potential Donald Trump presidency and contends with existing economic challenges, further policy support may be required to stabilise fragile growth.

Core inflation in Japan's capital accelerated in November and stayed above the central bank's 2% target as price pressures broadened, keeping alive market expectations the Bank of Japan (BOJ) would raise short-term interest rates from the current 0.25% at its next policy meeting in December.

Asset class review

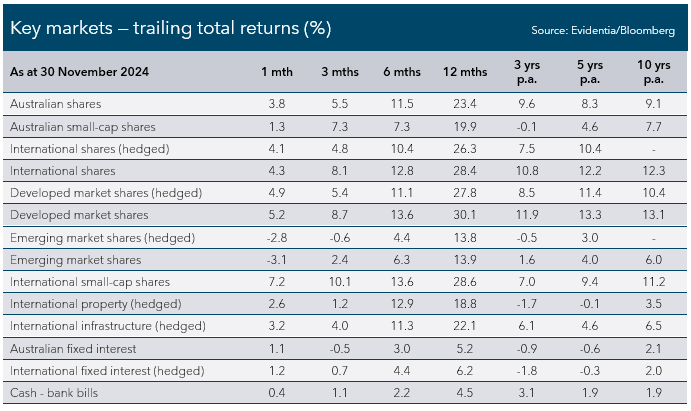

Australian shares

Australian shares rebounded in November. Record highs across multiple sectors pushed returns for the local market ahead of most other major markets, with the exception of the US. The S&P/ASX 200 Index posted a gain of +3.8%. Smaller companies’ recent run of outperformance relative to their larger counterparts ended, although the S&P/ASX Small Ordinaries Index still recorded a solid +1.3% return for the month.

Sector performance was broadly positive in November, with only a pair of detractors. Information technology (+10.5%) surged on strong US tech performance and positive domestic earnings updates. Falling yields were a tailwind for interest-rate-sensitive utilities (+9.1%), consumer discretionary (+6.9%) and real estate (+6.4%), which all made strong gains. Financials (+7.0%) also enjoyed a strong month, buoyed by further gains from the major banks. Materials (-2.6%) and energy (-0.7%) underperformed with the prospect of US tariffs on China weighing on miners and easing Middle East tensions pressuring oil prices despite talk of potential OPEC+ production cuts.

International shares

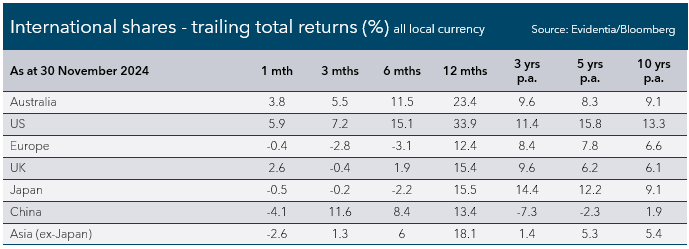

International shares delivered mixed returns in November, with the US surging ahead and Asia lagging. A slight decline in the Australian dollar saw unhedged returns edge out hedged returns for the month. The MSCI All Country World Index climbed +4.3%, while the hedged index advanced a similar +4.1%. Global small companies were one of the biggest beneficiaries of Trump’s victory and the prospect of policies that will spur growth domestically. The MSCI World ex-Australia Small Cap Net Return AUD Index jumped an exceptional +7.2%. Sector performance continued the broadly positive theme. Consumer discretionary (+9.6%) made outstanding gains due to falling interest rates and strong earnings updates from key retailers. Financials (+8.4%) and energy (+5.4%) sectors performed well, benefiting from expectations of de-regulation under a Trump presidency. While information technology (+5.3) and industrials (+5.0%) recorded solid gains.

US shares led global markets as the prospect of further rate cuts in the new year eased concerns about Trump-induced inflation towards the end of the month. The S&P 500 Index advanced an impressive +5.9% in November, while the tech-concentrated Nasdaq Composite Index moved +5.7% higher. The FTSE 100 Index gained +2.6% in November. This performance was primarily driven by a weaker pound, which enhanced the value of internationally focused companies within the index. Conversely, the Euro Stoxx 50 Index retreated -0.4% for the month, with uncertainty about future US trade tariffs and weak demand from China weighing on export-focused companies. Turbulence in the yen and mixed domestic economic indicators dampened investor sentiment in Japan, with the Topix Total Return Index giving back -0.5%. Emerging markets also retreated. The MSCI Emerging Markets Index (Hedged) moved -2.8% lower in November, lagging most developed markets. Chinese shares experienced a weaker month as concerns around trade tensions impacted returns. The MSCI China Net Total Return Index fell -4.1%.

Property and infrastructure

Further policy easing in the US and declining bond yields boosted returns for interest-rate-sensitive global property and infrastructure assets. Rebounding in November, the FTSE Global Core Infrastructure 50/50 (Hedged) Index gained +3.2%, while the property-focused FTSE EPRA Nareit Developed Index (Hedged) rose +2.6%.

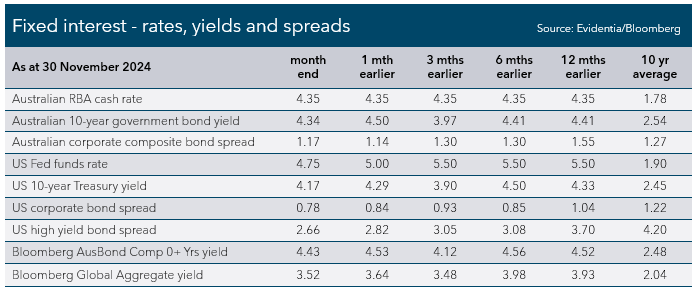

Fixed interest

Fixed interest markets closed November on a positive note, overcoming early-month volatility. Bond yields initially climbed on fears that Trump's inflationary policies could compel the Fed to maintain higher interest rates for longer. However, yields later retreated as markets reconsidered the timeline and potential impact of these policies, leading to renewed optimism in bond markets. The 10-year US Treasury yield eased -0.12% to 4.17%, while the 10-year Australian Government Bond yield retreated -0.16% to 4.34%. Falling yields were a tailwind for returns from global and Australian bond indices. The Bloomberg Global Aggregate Bond Hedged Index gained +1.2% for the month, while the Bloomberg AusBond Composite 0+ Yr Index rose +1.1%. Tightening spreads (the additional yield a corporate bond offers over a government bond with the same maturity) in November was a tailwind for global credit markets (corporate bonds). Global investment-grade credit, as measured by the Bloomberg Global Aggregate Credit Total Return Index Hedged AUD, advanced +1.3%. Spreads also narrowed for global high yield credit, with the Bloomberg Global High Yield Total Return Index Hedged AUD rising +1.3%. Returns from the Australian credit benchmark were more modest, with the Bloomberg AusBond Credit 0+ Yr Index advancing +0.9%.