Market Update

On the 23rd of March 2020, the Australian share market bottomed with an intra-day low of 4,402 points. One year on and we are yet to see our local market recover to its prior high reached in February 2020, but indices such as the Dow Jones and S&P500 (in the US) have actually surpassed their prior highs.

Locally our employment data was very strong with unemployment rates falling to 5.8%, which was much better than expectations. In addition, the percentage of the population working also rose to 62.3%, albeit slightly below the pre-Covid level of 62.7%. This is far better than expected and supports the view that the JobKeeper expiration may not be as painful as many suggest.

Not surprisingly population growth has slowed dramatically due to immigration largely ceasing. This will cause some headwinds for overall economic growth and housing demand, but it will assist the unemployment rate. We do however note housing demand is currently very strong. Going forward we suspect a hot topic politically will be immigration, particularly given Australia’s attractiveness has likely increased as a result of Covid.

Is Covid-19 almost over?

We of course hope so. But the reality is that no one knows, as we don’t know how this virus will mutate over time.

There is a lot of information available for those who are interested, but we thought a very brief summary would be helpful.

Vaccines work with the immune system. The vaccine shows our immune system what the virus looks like and gives it the tools to pre-warn it so that it can fight the virus. The issue is that they have only shown the immune system a critical part of the virus called the “spike protein”, not the whole virus. This was done due to time constraints – whilst blueprinting the whole virus is a better option, it is far more time-consuming, and of course time was of the essence. The good news is that the whole of virus vaccine is still being developed.

So, what’s the issue? Well, the virus copies itself millions and millions of times and now and then the copies aren’t perfect replicas. If the blueprint for the spike protein changes, the ability to recognise the virus is impeded. If enough changes happen, the spike protein may become unrecognisable, and an escape mutant emerges. The escape mutant is likely to become the dominant strain.

Copying errors are already occurring and the mutations in Brazil and South Africa have significantly undermined the body’s immune system to recognise the spike protein, resulting in material reductions in the vaccines’ effectiveness. To date the UK and US mutations have not compromised the effectiveness of the vaccines.

Can’t we just recode the vaccines for the mutations? Altering a change of shape in the spike protein should be easy to recode. However, a “stealth change” is another story. This type of change makes part of the spike protein invisible to antibodies and as a result is potentially much more complicated to recode.

These complications have led Hamish Douglas of Magellan to describe the current situation as “the most complex risk environment the world has seen for many years.”

Interest rates

As most of you would be aware, interest rates are at levels we have never seen before. The question many market participants are asking is when will central banks start raising rates and where will they get to?

One of the most critical factors to interest rates is inflation. If inflation rises, it is expected so too must interest rates. Interestingly, market pricing for 2-year inflation expectations in the US is now nearing 3% which is well beyond the Fed’s (US Federal Reserve) 2% target. As such the market is getting quite uncomfortable with the Fed’s stance of continued low rates for some time.

If we do get some inflation as per market pricing, will it be transitory? The Fed seems to think it will be, but the market remains less convinced. Five members of the FOMC (Federal Open Market Committee) are expecting 3 to 4 0.25% hikes by the end of CY2023, whilst 11 see no such increases. For what it’s worth, the market has a better record of predicting interest rate movements than the members themselves.

Economist and former US Treasury Secretary Larry Summers has also given his 2 cents - the US is plugging a 3-4% gap in GDP with 14% worth of stimulus. Basically, this means the US has overstimulated and as a result inflation is coming.

Some advice I was given many years ago - if you’re a share investor, watch the bond market and if you’re a property investor, watch the bond market and if you’re bond investor… watch the bond market. The bond market is the interest rate market, and it is possibly one of the most important markets to understand when investing in any asset class. In short, the lower rates are, the more reasonable it is to pay more for these assets and of course vice versa.

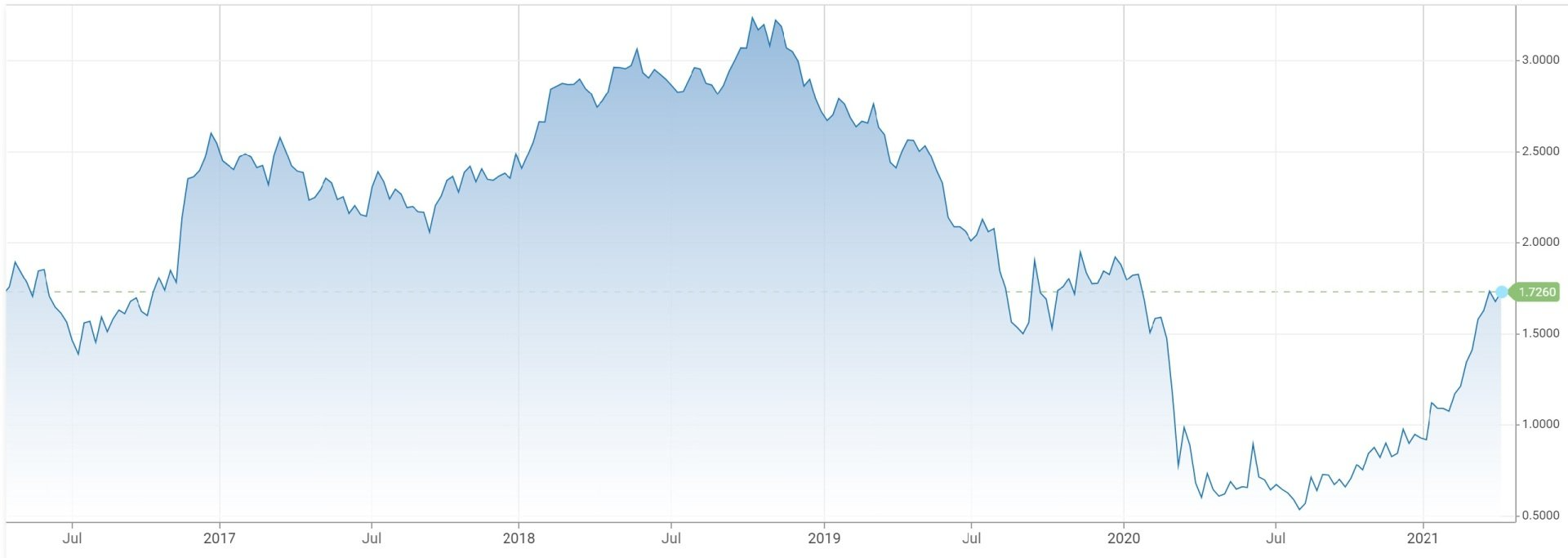

As you can see below, whilst the 10-year bond yield is still low, it has aggressively moved up in recent weeks highlighting the market’s expectations of future rate hikes. This move has particularly affected growth stocks like technology companies.

Where will the 10-year bond yield settle? Assuming an economic recovery, we would expect somewhere in the 3% range. However, if inflation really picked up you could see it breach 4%.