1st July 2022 Changes

Various changes have been made to the superannuation environment through the year that all have the commencement date 1 July 2022. Many of these changes were announced as part of the Budget introduced in April of this year.

Changes to the superannuation environment are important. Super is usually the most tax concessional environment available to investors, especially those that are entering into retirement. These changes will help people to move more money into the superannuation environment to fund their retirement.

Removal of the work test

Currently if you are between the ages of 67-74 you need to meet the work test (worked for at least 40 hours in a consecutive 30 day period in the financial year) to be able to contribute to superannuation.

As of 1 July 2022 you do not need to meet the work test. This means that it is easier for you to make contributions to super.

You will still need to meet the work test if you want to claim a tax deduction on any of the contributions you make.

Bring forward rule for under 75

The bring forward rule allows you make up to three years of contributions in one financial year. Currently you need to be less than 67 to be eligible to use the bring-forward rule.

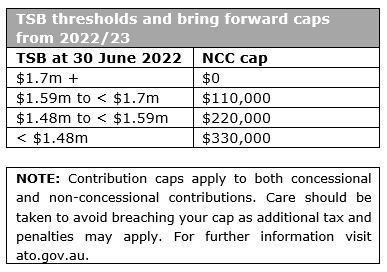

From 1 July 2022, if you are under 75 years of age at any time in a financial year you may be able to make non-concessional (after-tax) contributions of up to three times the annual non-concessional cap in that financial year. Other eligibility rules will continue to apply, such as the total super balance limits.

The following table summarises the maximum non-concessional contributions (NCC) that can be contributed in 2022/23 based on your total super balance (TSB) as of 30 June 2022:

Downsizer contributions to superannuation

Downsizer contributions allow eligible individuals to contribute some or all of the proceeds of the sale of their home, without impacting other contribution caps. Unlike NCCs, downsizer contributions do not have a total super balance limit, or an upper age limit. This means it could be a great, final way to boost super for those who don’t meet other eligibility rules to contribute, or where the NCC cap has been earmarked for other purposes.

From 1 July 2022, the eligibility age is reducing from 65 to 60. The age reduction increases the number of individuals who may be eligible to make a downsizer contribution and boost their retirement savings.

Provided certain other conditions are met, it may be possible to contribute up to $300,000 per person (or $600,000 per couple) from the proceeds of selling your home.

Downsizer contributions won’t count towards your concessional or non-concessional contribution caps.

You’ll need to make the contribution within 90 days of settlement of your sale, and you need to complete the required forms to notify your fund that you’re making a downsizer contribution, no later than the time your contribution is made. You must have reached the eligibility age at the time of contributing.

The First Home Super Saver Scheme

The First Home Super Saver Scheme (FHSSS) allows you to make voluntary contributions of up to $15,000 per year within your concessional and NCC caps. You can later withdraw an amount equal to those voluntary contributions plus earnings (calculated at a set rate by the ATO on the amount you withdraw).

The maximum amount of voluntary contributions that you can withdraw increases from $30,000 to $50,000 from 1 July 2022. This boosts the amount that can be accessed from super and directed to buying your first home.

As the scheme allows the withdrawal of voluntary contributions, consideration must be given to not only whether using super is the right approach for you but the type of contribution you will make. For example, salary sacrifice amounts (if an employee), personal deductible contributions or non-concessional contributions.

There is a range of criteria to withdraw your super under this scheme as well as ensuring the funds are used to purchase your first home which is outlined on the ATO website.

More employees eligible for superannuation payments

Superannuation Guarantee (SG) requires employers to pay a minimum level of super support for eligible employees. One criteria for an employee to be eligible is based on that employee’s monthly earnings being at least $450 per month. However, this threshold is abolished from 1 July 2022 allowing all eligible employees to receive SG paid into their super fund. Employees will still need to satisfy other eligibility requirements.

This measure primarily assists low-income earners to have employer contributions paid to super, boosting their retirement savings.

SG contributions count towards your concessional contribution cap and should be taken into consideration when determining any other contributions made.

To check if you need to pay super for your employees, head to the ATO Super Guarantee eligibility tool: https://www.ato.gov.au/business/super-for-employers/work-out-if-you-have-to-pay-super/

Increase in Super Guarantee

From 1 July 2022, the percentage rate for the Super Guarantee (SG) increases from 10% to 10.5%. Employers are required to contribute additional money into their employees’ super accounts in line with the higher SG percentage rate.

The SG rate has been 10% since 1 July 2021 and under the current schedule of legislated increases, the percentage rate will rise again to 11% on 1 July 2023. It will continue rising 0.5% each year until it reaches its final rate of 12% on 1 July 2025.

Minimum drawdown rate

The Government has extended the measure introduced in March 2020, allowing retirees to withdraw half the normal minimum amount from their super. Retirees can now leave more money in their super without having to pay additional tax on their earnings.

This extension applies to the end of June 2023.