The Budget Measures

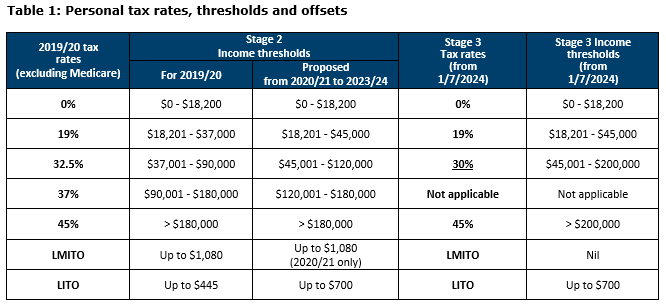

- Tax cuts for low and middle income earners by bringing forward the ‘Stage 2’ tax relief, increasing the Low Income Tax Offset and retaining the Low and Middle Income Tax Offset in the current tax year.

- Tax relief for businesses, including instant asset write-offs and Fringe Benefit Tax (FBT) concessions.

- A range of measures to maximise retirement savings for Australians, including a new online YourSuper comparison tool and changes to ensure an employee’s super fund follows them when changing jobs.

- Additional payments (comprising two amounts of $250) for eligible income support recipients and concession card holders.

- A capital gains tax exemption for granny flat rights supported by a formal written agreement.

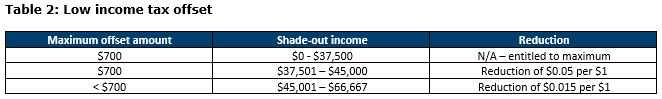

The maximum LITO amount is increasing from $445 to $700 in 2020/21. The table below summarises the tax offset available.

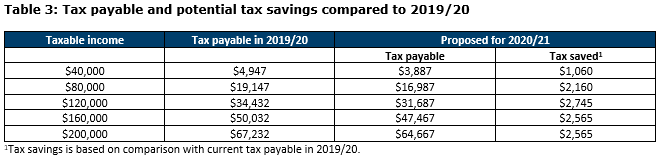

Table 3 below illustrates the tax payable in future financial years and the potential tax savings compared to 2019/20, for a range of taxable incomes. These figures take into account the proposed personal income threshold and tax offset changes.

Tax concessions for small business

Date of effect: Various

Small business tax concessions

Tax concessions to small businesses with a turnover of up to $50 million will be expanded as follows:

- From 1 July 2020, eligible businesses would be able to immediately deduct start-up expenses and certain pre-paid expenditure.

- From 1 April 2021, eligible businesses will be exempt from FBT on car parking and multiple work-related portable electronic devices.

- From 1 July 2021, eligible businesses will have simplified trading stock rules, a change to calculation of Pay-As-You-Go instalments and changes to excise and customs duty. A two-year amendment period will apply for income tax returns starting 1 July 2021.

Fringe Benefit Tax exemption for training

An exemption from FBT will be provided to employers providing training and reskilling to redundant or soon to be redundant employees. Ordinarily, FBT would apply if the training provided is not sufficiently connected to the current employment. The exemption will apply from 2 October 2020 (date of the announcement).

Additionally, the Government will consult on possible changes for employees that undertake training at their own expense. Currently, a tax deduction is only available where the training relates to the current employment.

Temporary full expensing of capital assets

Date of effect: From 7 October 2020

Businesses with an aggregated turnover of less than $5 billion will be able to deduct the full cost of eligible capital assets acquired from 7 October 2020 and used or installed by 30 June 2022. Also, in that period:

- Small businesses with an aggregated turnover of less than $10 million can claim a deduction for the full balance of their simplified depreciation pool, and

- Businesses with an aggregated turnover of less than $50 million can also expense second-hand assets.

Temporary loss carry-back

Date of effect: 1 July 2020

Companies with an aggregated turnover of less than $5 billion can carry back losses in each of 2019/20, 2020/21 and 2021/22 tax years against any profits in 2018/19 or later years. The carry back will give rise to cash refunds of tax previously paid.

Superannuation

Superannuation reform

Date of effect: Staged introduction

The Government will introduce a range of measures to improve outcomes for superannuation members. The focus is to reduce the number of duplicate accounts and to protect members from poor outcomes and encourage funds to lower costs. The measures include:

- The ATO to develop systems enabling new employees to nominate a MySuper fund through the YourSuper portal. This will also provide an online comparison tool.

- Existing superannuation members will have a current account ‘stapled’ to avoid the creation of a new account when the person changes employment. By 1 July 2021, if an employee doesn’t nominate an account when starting a new job, employers will pay their super contributions to their existing fund. While a person may have multiple funds, this will be by choice.

- Payroll systems to simplify the process of selecting a superannuation fund by both employees and employers by automating provision of information to employers.

- From July 2021, APRA will conduct benchmarking of MySuper products based on net investment performance. MySuper products that have underperformed over two consecutive annual tests will be prohibited from receiving new members until they cease underperforming. This will be extended to non-MySuper products from 1 July 2022. Underperforming funds would need to notify members and refer members to the YourSuper comparison tool.

- Additional obligations will be placed on trustees to ensure decisions are in the financial interest of members, including focus on maximising members’ retirement savings and providing better information on management and expenditure within the fund prior to the Annual Members’ Meeting.

Social security

Economic stimulus payments

Date of effect: From November 2020

Two Economic Stimulus payments of $250 each will be paid on 30 November 2020 and 1 March 2021 to recipients of certain Government payments and concession card holders. The payments will be received tax free and will not be assessed as income for means testing.

Both $250 payments will be made to those receiving:

- Age Pension

- Disability Support Pension

- Carer Payment

- Carer Allowance

- Family Tax Benefit

- Pension Concession Card Holders

- Commonwealth Seniors Health Card holders, and

- Eligible Veterans Affairs payment recipients and concession card holders.

Individuals who are in receipt of more than one of the qualifying payments or concession cards will only be eligible to receive each of the stimulus payments once.

Youth allowance independence test

Date of effect: From November 2020

Individuals applying for Youth Allowance or ABSTUDY, who are aged 21 or younger, will have all periods between 25 March and 24 September 2020 recognised as contributing to the independence test, regardless of whether the employment requirements have been met.

Ordinarily, a person would need to work full time for at least 18 months in total, within a two-year period, to be assessed as independent for these payments. Where an applicant doesn’t meet these requirements and fails to meet one of the other requirements to be assessed as independent, they are assessed as dependant and a parental income test will generally apply to determine eligibility.

In addition, Youth Allowance and ABSTUDY recipients who earn at least $15,000 from work completed in the agricultural industry between 30 November 2020 and 31 December 2021 will automatically meet the independence requirements. Parents must continue to meet current income test requirements.

Granny flat rights and capital gains tax

Date of effect: From 1 July 2021

A capital gains tax (CGT) exemption will apply to granny flat rights that are supported by a formal written agreement. The intention is to strengthen the financial and legal security of individuals entering into these arrangements, by removing often significant tax consequences associated with formalising these types of agreements.

Granny flat arrangements often include an older person transferring:

- Legal title of their exiting home in return for a right to occupy the home for life.

- Legal title of their home, plus other assets, in return for a right to occupy the home for life.

- Paying for the construction of or renovations to another dwelling, or

- Transferring cash or other assets, in return for a right to occupy another person’s home.

The CGT implications of granny flat arrangements are complex. Importantly, often significant CGT consequences can arise.