Keeping You Informed

Market Update

It has been 11 weeks since the Coronavirus (COVID-19) outbreak was diagnosed in China. Australia’s first case was detected in Victoria, on 25 January. We can expect that the virus, along with the response to slow its spread, will have significant economic implications for some time to come.

The global nature of the shock continues to be evident in financial markets. Markets started this downturn in a relatively orderly fashion largely in response to the estimated supply side shocks resulting from China isolating affected cities to prevent the virus spreading.

Markets were impacted more seriously as it became apparent that the virus was not limited to China and countries across the globe would have to adopt similar strict social isolation lockdowns. The fear created by this realisation has been the catalyst for unprecedented selling across all asset classes. Assets are being sold indiscriminately and as the selling deepens, there are fewer buyers. This search for liquidity has caused a clear dislocation across all asset classes.

It is reasonable to expect the environment of negative news to continue for several weeks and people will try to understand and measure their economic effects whilst also adapting to the containment measures. We may be in for several weeks of unsettling headlines and continued volatility.

The upshot is that, having priced in a huge drop in earnings, there is a chance the equity market has entered a phase where we could see a rebound as it starts to factor in the effect of fiscal measures feeding through. There is an elevated risk of investors being ‘whipsawed’ here – selling out in an attempt to buy in at lower levels and missing a material bounce.

We are very mindful that the speed and ferocity of the share market falls have been a cause of distress. The social distancing and broader lockdown measures to contain the virus have contributed further to the feeling of anxiety.

This is a very difficult time and we encourage everyone to maintain a focus on personal health, look after your family and try to refrain from focusing on the short-term volatility we are seeing in the financial markets. We firmly believe that financial markets will rebound as stability returns and we will get through this period.

Perhaps unsurprisingly, we all want clarity around when we can expect to see markets stabilise. Respected analysts are suggesting this is dependent on the infection rate of the virus being managed. Confidence in China and South Korea has increased as rates of infection and death rates have started to fall. It is encouraging to hear that these same analysts suggest that if the Chinese and South Korean experience can be replicated, these inflection points could occur as soon as mid to late April for other major economies.

Can we expect a vaccine or treatment to assist in the response to COVID-19? Yes, we consider it reasonable to expect that scientists will identify a drug that can manage the effects of this virus in the short term. A vaccine to prevent infection is more likely to be a year away due to stringent testing requirements. However, we understand that a drug that can treat the effects of this virus will have the greatest positive impact if the community also manages to reduce the underlying infection rates.

The more we, as a community, can adhere to the strict lockdown and social distancing regime being imposed, the greater the chance we have of softening the economic impact of the virus.

The Government and the Reserve Bank of Australia (RBA) are acting decisively to support households and businesses and address the significant economic consequences of the Coronavirus. We consider it is reasonable to consider the Government and RBA will continue to provide support until the economy stabilises.

While we consider this support is critical and will be a huge benefit, we also expect a deep negative economic impact to come from the virus as the control measures impact around the globe.

Summary of Measures

The measures announced by the Prime Minister are reported as having bipartisan support. However, as they are new spending measures they need to pass through normal parliamentary procedures before they can be implemented in full. The final detail will not be available until the relevant bills are brought to Parliament.

The Federal Budget that is usually delivered in May has been delayed until later in the year. It is reasonable to think of these measures as Budget measures that have been brought forward in challenging circumstances.

Social security

• The Government is providing two separate $750 payments to social security, veteran and other income support recipients and eligible concession card holders prior to 12 March 2020. The first payment will be made from 31 March 2020 and the second payment will be made from 13 July 2020.

• A time-limited Coronavirus supplement will be paid over the next six months at a rate of $550 per fortnight. This will be paid to both existing and new recipients of Jobseeker Payment, Youth Allowance Jobseeker, Parenting Payment, Farm Household Allowance and Special Benefit.

• Current waiting periods have been waived and benefit applications are being fast tracked.

• Reduction in deeming rates as of 1 May 2020, the upper deeming rate will be 2.25 per cent and the lower deeming rate will be 0.25 per cent. The change will benefit around 900,000 income support recipients, including around 565,000 Age Pensioners.

Superannuation

Early release of superannuation

• Subject to conditions of financial stress, individuals affected by the Coronavirus are allowed to access up to $10,000 of their superannuation in 2019-20 and a further $10,000 in 2020-21. These payments are tax free and the money they withdraw will not affect Centrelink or Veterans’ Affairs payments.

Temporarily reducing superannuation minimum drawdown rates

• Temporary reduction to the minimum drawdown requirements for account-based pensions and similar products by 50 per cent for 2019-20 and 2020-21.

Support for businesses

There are several measures to assist cash flow for small to medium size business focussed on those businesses that are employing people. The policy is aimed at reducing the potential for an unemployment spike in the short to medium term.

These measures include;

• Lump sum payment to employers who employ people

• Deferment of loan payment for 6 months

• Loan guarantee scheme

• Instant asset write offs

• Accelerated depreciation to 30 June 2021

• Support for apprentices and trainees.

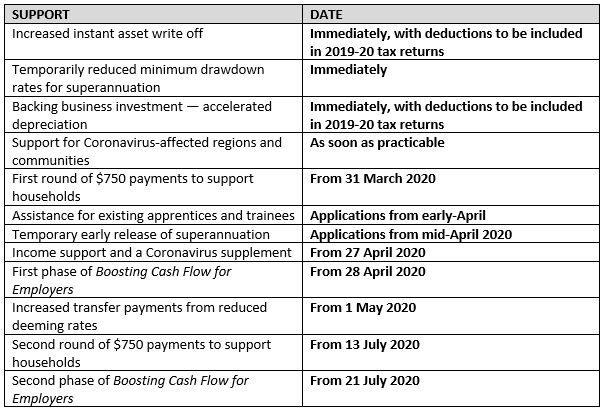

Package Implementation

The Government is moving quickly to implement this package. To that end, a package of Bills was introduced into Parliament on 23 March 2020 for urgent consideration.

Subject to passage of the Bills through Parliament, the Government will then move to immediately make, and register, supporting instruments.

Timing of Assistance

If clients have any concerns or questions please feel free to contact us here at the office on 4613 0514. Ben and Martin are available to speak with you by mobile and email.

The office will be operating as usual unless stricter measures are put in place by the Government. If this does occur and the office is closed, our team has the ability to work from home and can continue to service our clients.

In the meantime, reviews and meetings will be conducted via phone where possible and all precautions taken if clients do need to come to the premises.

Please take care of yourself, your family and the community during this difficult time.