Call Us 07 4613 0514

Call Us 07 4613 0514

Advice Tailored to You

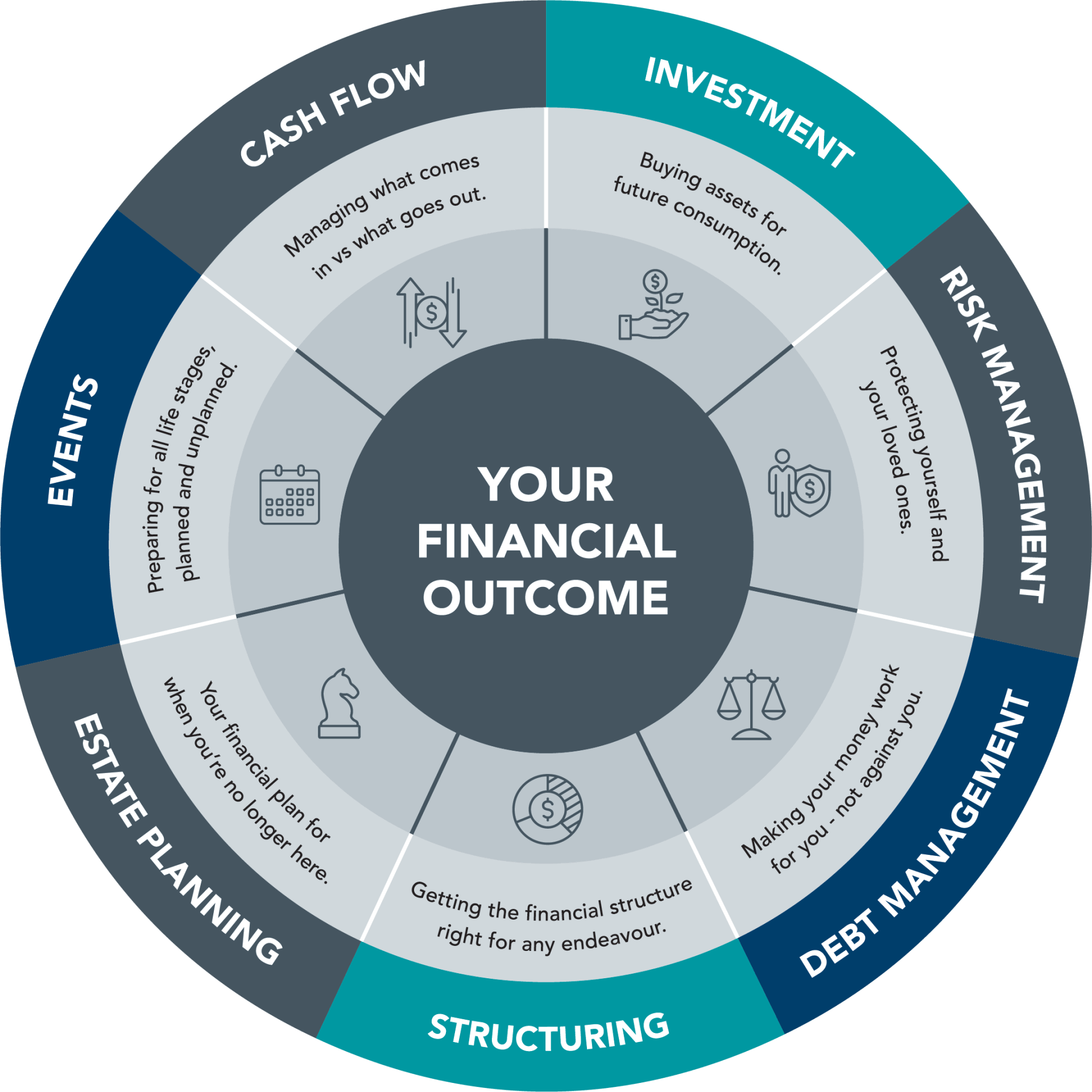

Graham Financial offers a complete advisory service that is personalised and tailored to your unique financial situation. Our holistic approach will provide significant and long term benefits to your financial outcome. View our

Financial Services Guide.

We find clients will recognise they need assistance with one segment of the wheel, however it is the interaction and understanding of all the segments that provides financial security, at all life stages.

- CASH FLOW

- Income in retirement

- Centrelink benefits

- Income vs Expenses

- Budgeting

- Employee vs Self Employed

- Lifecycle spending

- EVENTS

- Retirement

- Divorce

- Death

- Children

- Education

- Redundancy

- Disability

- Financial Windfall

Talk with us about planning for events that could effect your finances.

- ESTATE PLANNING

- Wills

- Enduring power of attorney

- Intergenerational transfer of assets

- Probate

- Binding death benefit nominations

- Estate assets

- Non-estate assets

- Split families

- STRUCTURING

- Tax effective

- Superannuation

- Trusts

- Company

- Asset protection

- Transfer balance Cap

- Capital Gains tax

- Insurance bonds

- Small business concessions

- Concessional or non concessional contributions

- Super caps

- Ownership

- Joint tenants vs tenants in common

- INVESTMENT

- Shares (Equities)

- Commercial/Industrial property

- Residential property

- Bonds - corporate and Govt

- Cash

- Managed funds

- Term Deposits

- ETF's/LIC's/SMA's/MIT's

- Debentures

- Derivatives

- Hybrids

- Macro economics

- Economic cycles

- Tax efficiency

- RISK MANAGEMENT

- Asset protection

- Life insurance

- Income protection

- Total and permanent disability

- How much insurance is enough?

- Business insurance

- Key man risk

- Transfer of risk

- How much risk is too much?

- Asset allocation

- DEBT MANAGEMENT

- Negative gearing

- Fixed vs floating rates

- Good vs Bad debt

- Deductible vs non-deductible debt

- Debt recycling

- Appropriate leverage

- Repayment pathway

- Refinancing

- CASH FLOW

- Income in retirement

- Centrelink benefits

- Income vs Expenses

- Budgeting

- Employee vs Self Employed

- Lifecycle spending

- EVENTS

- Retirement

- Divorce

- Death

- Children

- Education

- Redundancy

- Disability

- Financial Windfall

Talk with us about planning for events that could effect your finances.

- ESTATE PLANNING

- Wills

- Enduring power of attorney

- Intergenerational transfer of assets

- Probate

- Binding death benefit nominations

- Estate assets

- Non-estate assets

- Split families

- STRUCTURING

- Tax effective

- Superannuation

- Trusts

- Company

- Asset protection

- Transfer balance Cap

- Capital Gains tax

- Insurance bonds

- Small business concessions

- Concessional or non concessional contributions

- Super caps

- Ownership

- Joint tenants vs tenants in common

- INVESTMENT

- Shares (Equities)

- Commercial/Industrial property

- Residential property

- Bonds - corporate and Govt

- Cash

- Managed funds

- Term Deposits

- ETF's/LIC's/SMA's/MIT's

- Debentures

- Derivatives

- Hybrids

- Macro economics

- Economic cycles

- Tax efficiency

- RISK MANAGEMENT

- Asset protection

- Life insurance

- Income protection

- Total and permanent disability

- How much insurance is enough?

- Business insurance

- Key man risk

- Transfer of risk

- How much risk is too much?

- Asset allocation

- DEBT MANAGEMENT

- Negative gearing

- Fixed vs floating rates

- Good vs Bad debt

- Deductible vs non-deductible debt

- Debt recycling

- Appropriate leverage

- Repayment pathway

- Refinancing

- CASH FLOW

- Income in retirement

- Centrelink benefits

- Income vs Expenses

- Budgeting

- Employee vs Self Employed

- Lifecycle spending

- EVENTS

- Retirement

- Divorce

- Death

- Children

- Education

- Redundancy

- Disability

- Financial Windfall

Talk with us about planning for events that could effect your finances.

- ESTATE PLANNING

- Wills

- Enduring power of attorney

- Intergenerational transfer of assets

- Probate

- Binding death benefit nominations

- Estate assets

- Non-estate assets

- Split families

- STRUCTURING

- Tax effective

- Superannuation

- Trusts

- Company

- Asset protection

- Transfer balance Cap

- Capital Gains tax

- Insurance bonds

- Small business concessions

- Concessional or non concessional contributions

- Super caps

- Ownership

- Joint tenants vs tenants in common

- INVESTMENT

- Shares (Equities)

- Commercial/Industrial property

- Residential property

- Bonds - corporate and Govt

- Cash

- Managed funds

- Term Deposits

- ETF's/LIC's/SMA's/MIT's

- Debentures

- Derivatives

- Hybrids

- Macro economics

- Economic cycles

- Tax efficiency

- RISK MANAGEMENT

- Asset protection

- Life insurance

- Income protection

- Total and permanent disability

- How much insurance is enough?

- Business insurance

- Key man risk

- Transfer of risk

- How much risk is too much?

- Asset allocation

- DEBT MANAGEMENT

- Negative gearing

- Fixed vs floating rates

- Good vs Bad debt

- Deductible vs non-deductible debt

- Debt recycling

- Appropriate leverage

- Repayment pathway

- Refinancing

- DEBT MANAGEMENT

- Negative gearing

- Fixed vs floating rates

- Good vs Bad debt

- Deductible vs non-deductible debt

- Debt recycling

- Appropriate leverage

- Repayment pathway

- Refinancing

Reach Out

Sound financial advice is based on years of training, hard work, experience and passion.

Take a step closer to financial freedom, contact Graham Financial.

Take a step closer to financial freedom, contact Graham Financial.

Thank you for contacting us.

We will get back to you as soon as possible.

There was an error sending your message.

Please try again later or call 07 4613 0514.

Newsletter Sign Up

Keep up with the latest financial planning advice & news.

Contact Us

Thank you for subscribing!

Oops. Something went wrong. Call us on 07 4613 0514

About Us

Based in Toowoomba Queensland, Graham Financial is a locally owned boutique financial planning practice.

© 2024

Graham Financial | Website by dms CREATiVE | Clear Pixel